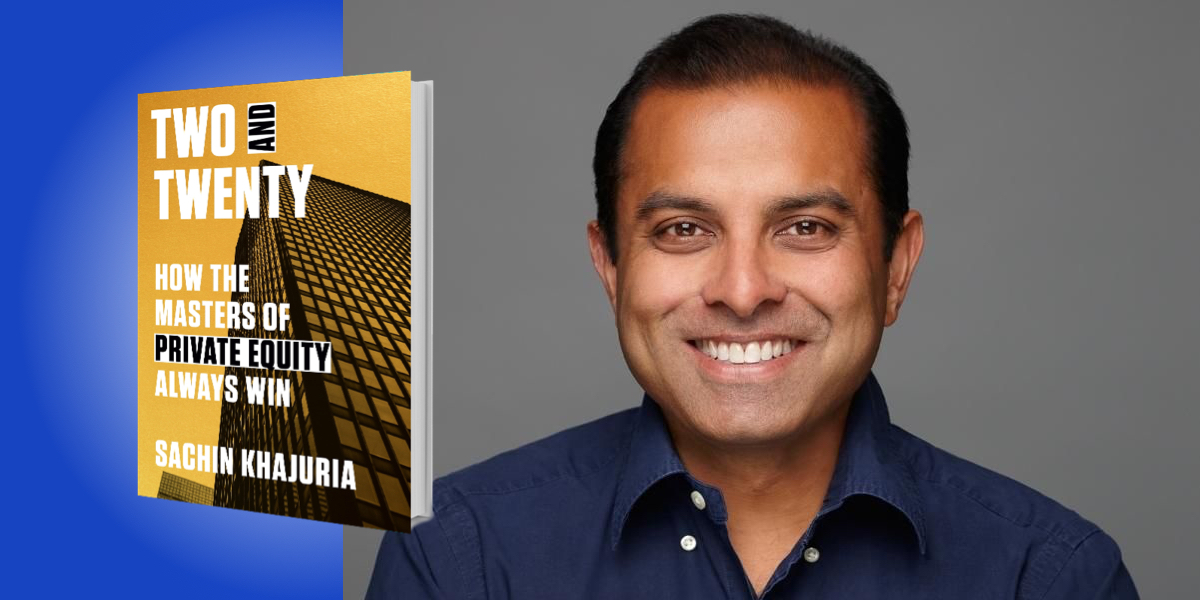

This book captures an insightful portrayal of the mindset behind the ‘masters of private equity,’ individuals who emerged to fill the void left by the 2008 financial crisis. According to Khajuria, big names like Blackstone and Carlyle are the face of this new ‘active investing.’

Traditionally, active investing involved analysts selecting unique stocks to beat the market. But these private equity firms are changing the game. They’re not just dabbling in industries; they’re taking over businesses and running the show for 5-10 years to rake in huge profits. Their ruthless yet highly effective strategies have led to an unprecedented increase in the size of these firms. Presently, the largest private equity firms have firmly established themselves in the public market. Their market cap is so large that they seem to be too big to fail. Perhaps it’s a foreshadowing for the next financial crisis.